This post may contain affiliate links, which supports me, but won’t cost anything extra to you.

With the Fall & Holiday season coming up, It’s the perfect time to start thinking about saving for the upcoming expected expenses as we get closer to these important dates. In order to get ready, it’s a great idea to get a sense of what our current finances look like and what little wiggle room we have. We want to make sure that we have some extra cash left over after every pay check to put inside our savings fund. But what could make saving a lot more fun? I know- some cool savings challenges! Using saving challenges will help keep you accountable in your savings so that you can meet your goals.

In this blog, I will present to you 7 Saving Challenges that I-myself recommend and would use.

But first, let me introduce myself!

Hello, I'm Wealth Wizard. I am newer to the blogging corner, but I really want to share some of my knowledge when it comes to personal finances as I used to question how to save until I truly understood self-control and knowledgeable decision-making.

- Wealth Wizard is just a funny little name I like to call myself as I help individuals like you build your wealth using simple techniques and strategies.

Please Considering Sharing/Saving This Pin! 🙂

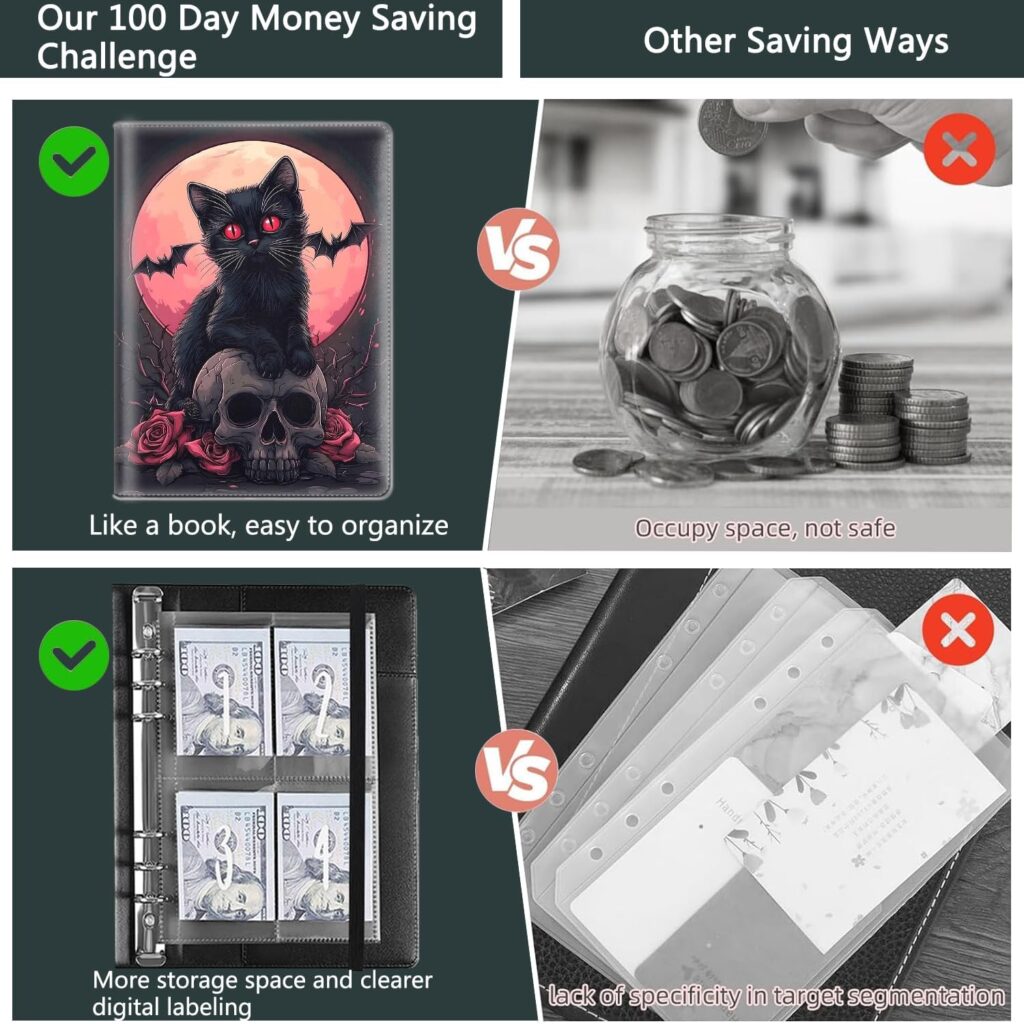

#1 HALLOWEEN SAVINGS BOOK

If you’re truly into Halloween and want a themed savings challenge, then I’d suggest something like this Spooky Black Cat Skull savings challenge as it’s quite the freight and pretty cool at the same time!

The Classic

This is one of the most casual and classic ways of saving, but it works if you stick to it! It’s a great way to stay properly themed while reaching your savings goals!

- There are also 36 other themes you can look at if this one doesn’t ring your bell.

#2 HOLIDAY JAR SAVINGS CHALLENGE

One pretty average and nice way to save is using a festive jar that you can throw loose change and bills into throughout the season. At the end of the season, you will count it and use that towards your holiday expenses. Using a themed jar for the season is just a plus. If you want any recommendations, here are a few I personally like!

These cute Halloween Ghost Face Jars are perfect to put your loose change in. I would probably organize the change in it if I had a set of three-that’s just my OCD speaking though.

This cute little guy is a perfect place to protect your treats (money). Just make sure you hide it from the kids as they may think there are cookies in there!

#3 ENVELOPE SAVINGS CHALLENGE

These Black Cash Envelopes are perfect for a specific savings challenge. After every pay check-or whenever you have extra cash laying around-stuff the cash in them. You will designate one envelope to each week, labeling them accordingly.

Once you have reached the expiration of your savings challenge, you will open them and sum what you have saved. It’s the most fun when you take out all the money and get to see how much you have actually saved. I like to guess the total with my family to see who was the closest.

#4 THE $5 HOLIDAY STASH

Now, personally, I love this challenge because it’s super simple and can add up pretty fast! Every time I find or get a $5 bill, no matter if it’s from breaking a 20, I make sure to set it aside. I will keep a little stash hidden away (just like the black envelopes in #3) just for holiday expenses.

The best part about all of this is how fast you can notice those $5 bills adding up as those holidays get closer! But let me tell you-I don’t actively seek them out, but the more I am focusing on continuing with this challenge, the more I feel like I have extra cash at the end of the weeks. It definitely feels less overwhelming than putting aside large lump sums every paycheck. And that is because I’m doing it gradually over time, one $5 bill at a time. I found for me personally, consistently adding to this fund, I can end up saving a decent amount without ever feeling like I’m short on money.

By the time the holidays have finally come around, I have this pretty significant little stash full of the amazing green stuff ready for gifts, decorations, or even a special holiday gift just for myself. This holiday saving method definitely has made my holiday spending so much easier as I know I have a decent amount of cash that’s been building slowly all year (or even just a couple months). This is a low pressure way to save that I’ve always recommended to friends and family who need a fun approach to budgeting for expensive holidays.

#5 NO SPENDING WEEKENDS

- This has definitely become one of my favorite ways to stop spending and be courteous of my expenses and put more money aside for the holidays during the year.

Here’s how it works: I will pick one weekend out of each month during the year, or maybe even two if I’m feeling extra saving savvy, and fully commit to spending absolutely nothing during that designated weekend. This means absolutely no dining out, no shopping trips, and no impulse purchases. Instead of this, I my best to focus on enjoying some free or low cost activities. Personally, I’ve found that this challenge not only helps me save, but also helps me get pretty creative with how I spend my time during these weekends. Some ideas are movie marathons, baking sessions, going to the gym or taking long walks to keep myself entertained without spending any moolah.

The real power of this challenge is to learn self control and the ability to reframe my mindset around spending money. It’s really easy to fall into the terrible habit of buying little things here and there, especially on weekends, but since I’ve learned to commit to the no spending weekend, I’m forcing myself to really think about what I want versus my needs. Every dollar I don’t spend during these weekends goes straight into my holiday savings, which honestly, it feels like a huge-mini victory every time I save money through the weekend. Also, I’ve noticed that after doing just a few of these weekend challenges, I’m so much more mindful about my overall spending, even outside of this challenge.

- And by the end of each month, I’ve usually been able to save a pretty decent amount ($300+) just from avoiding these unnecessary spending weekends. And when I look back at the money I’ve put into this holiday fund, it makes me feel amazing and in control of my finances. Also, I’ve even turned it into a little game. I challenge myself to see just how many weekends of no spending I am able to fit in before the holidays come around. The more I do this, the more I’ve saved, the easier it has gotten and the less stressed I now feel about the usual holiday expenses.

#6 GIFT CARD SAVING

- This one is actually one of the most fun and is my secret weapon for holiday budgeting in pair with the others. Sometimes I’ll switch up the challenges a bit as I like to kind of swap between a few.

Every time I do my regular shopping for groceries or just make a run for the usual household essentials, I’ll add a small gift card of about $10 or $15 into the cart. I will make sure to buy gift cards from stores that I know I’ll be shopping at during the holidays, such as Amazon, Target, or even favorite restaurants. And the best part? These small amounts of money don’t feel like much at the time, but as the time goes on and I keep to it throughout the year, they build up into a substantial amount. It’s like free money I didn’t even know about!

And what I truly love about this specific trick is how effortless it feels. I’m already shopping, so why not add a small gift card to my total? It doesn’t impact my budget much in the short term, and in the long term, they build up largely. I will stash these gift cards in a drawer or a box somewhere, and as the months go by, the collection of cards grow. (It looks incredibly sick seeing so many cards to be honest). And by the time Christmas has finally arrived, I have built up a very nice “little” pile of gift cards that I will use for gifts, meals, or the usual holiday shopping without having to dip into any of my actual cash savings. It definitely feels like I’m treating my future self every time I add to the growing pile.

When it’s finally time to start the long-awaited holiday shopping, I will go through the large stash of gift cards, and it’s quite literally like having a gift card shop in my house- it’s like a prepaid shopping spree! Not only am I avoiding racking up lots of extra expenses during the already quite expensive season, but I feel super proud of how much I’ve actually saved. This trick alone has made my holiday shopping so much less stressful, and I love it that I don’t have to start scrambling to find the money for last minute gifts or expenses.

#7 THE 30 DAY HOLIDAY PREP

This mini challenge I’m about to share with you is quite aggressive, but is pretty useful if you’re in need of money asap for the holidays and only have a month to save. You can definitely be more aggressive with this strategy, but I’m going to give you an example with a smaller amount of money.

My money head likes doing challenges, so, to jumpstart my holiday, I’ll do a 30 day Holiday Prep challenge. It’s a pretty simple simple idea- over the course of the next 30 days, I will challenge myself to save an increasing amount of money each day. On Day 1, I save $1, on Day 2, I save $2, and so on until I reach Day 30, where I save $30. By the end of this 30 days, I will have saved $465! It’s quite a fun way to build up savings pretty progressively, and since the amounts start small, it doesn’t feel overwhelming in the beginning.

What I personally love about this specific challenge is how it builds momentum. In the early days, saving just a few dollars is easy, but by the time the much larger amounts start to come around, I have to make sure that I’m already in the habit of putting a decent portion of money aside. I will usually plan out my expenses ahead of time, so that I know when I’ll need to set aside a little extra for the higher days. The challenge definitely pushes me to be more mindful of my daily spending, which not only helps to save for the holidays but also keeps me on track with my overall budget.

- And at the end of the 30 days, it feels pretty amazing to see that extra amount I’ve saved without making any drastic changes to my lifestyle-apart from the ending where it’s quite aggressive. I personally like to start this challenge in the fall, right before the holiday season kicks into high gear. I may even do a second challenge or just up the beginning amount depending on where my finances stand. And by the time December finally arrives, I already have a pretty substantial fund ready for holiday gifts, decorations, or even traveling. Plus, the sense of accomplishment after completing the challenge is a reward in itself.

Overall, incorporating any of these 7 savings challenges into your routine can definitely make saving for the holidays both fun and quite rewarding. Whether you’re putting away spare change or skipping the usual weekend spending spree, these simple strategies will most definitely help you to stay on track and ensure you have the funds that are needed for gifts, decorations, and everything else on the holiday expense list. The key is to find a challenge that fits your lifestyle and stick to it. Personally, I like switching up challenges every month, so I’ll definitely use all of them! So anyways, why not give one (or more) of these challenges a try? You’ll really be surprised at how quickly your holiday savings can and will add up! Happy saving, and may your holidays be full of joy and financial peace!