This post may contain affiliate links, which supports me, but won’t cost anything extra to you.

When it comes to financial success, your mindset and the way you go about things is everything. It doesn’t matter if you’re trying to save for a big purchase, save for your future endeavors, invest for the long term, or even pay off that debt that has been leaning on you for as long as you can remember. Staying motivated is the #1 thing to keep on the right path to financial success.

Now, this is where the power of words come in. Just a couple perfect-timed quotes could change your trajectory and light a fire within you. It’s crazy to think that when times get tough, some words thrown together can truly change how you think when it comes to money- or really anything in life!

In this article, I will share with you 10 of the most motivational and inspiring quotes to help you stay on track to your financial success and freedom- it’s a game changer! I’ll also dissect these quotes for you so that we can fully understand the underlying meaning behind it.

But first, let me introduce myself!

Hello, I'm Wealth Wizard. I am newer to the blogging corner, but I really want to share some of my knowledge when it comes to personal finances as I used to question how to save until I truly understood self-control and knowledgeable decision-making.

Wealth Wizard is just a funny little name I like to call myself as I help individuals like you build your wealth using simple techniques and strategies.

Please Considering Sharing/Saving This Pin! 🙂

This famous quote is a great example as to why just doing something instead of waiting for the “right time” is the key to success. Your intention on doing something isn’t going to get that thing done- doing it will. Taking only one step will get you one step closer to your goals!

Here is an example on how this can be applied – Instead of waiting until you’ve saved up a large sum of money before you start on your investment journey-start small. Even $10 here and there will build up over time and you won’t believe your returns!

If you really want to stick to this- use something like Webull as your investing platform- they have the ability to schedule auto transfers so that you don’t even have to think about investing! ~I use this platform for my investing as they have a mobile app, Roth IRA, high yield savings account and make it incredibly easy to invest and watch your portfolio grow!

Did I also mention that they don’t charge any commission fees?!

You should really just take a second and try to fully understand and comprehend what Benjamin Franklin is saying in this instance. Your financial success isn’t just saving or earning more money- it’s about the knowledgeable decisions you make with said money. This quote shows you the power of education- don’t take it for granted

If you truly want to progress on your financial journey and become financially literate, then I’d highly suggest investing in your education. Read some of the amazing finance books like The Psychology of Money by Morgan Housel or Think and Grow Rich by Napoleon Hill– you won’t regret it! I actually picked up Think and Grow Rich for myself not too long ago and loved it!

This is so so so true! Think- When you’re given only a certain amount of money every month to spend- you make it work. If you can live off of what you have AFTER you save and invest every month- then you are setup for an amazing financial future!

If you can prioritize saving over spending, then you can and will truly become wealthy in the future. All it takes is a little discipline and money management- and maybe a little bit of living below your means.

- How can I apply this to my life? Well, what I’d first suggest doing is setting up automatic transfers of money to your savings and investment accounts when you’re paid. Doing this will make sure that you are saving each month instead of having to manually transfer everything and ultimately forgetting to do it.

These are some of the truest words you will hear- It’s all about your spending habits.

If you can maintain enough financial control and discipline, you can live better off of $50,000 than most people with a $100,000 income. That is because of this magical phrase called living below your means. Basically, you are trying to spend as little as possible so that you are saving a good portion of your income every year. If you do this, you will end up being more wealthy in the future than most of these 6 figure income earners.

But- how come these people making $100,000+ a year are worse off than someone making $50,000? That doesn’t even make any sense.

Have you ever heard of the phrase “keeping up with the joneses”? This refers to the need to keep up with the social group around you. When John goes out and buys a new car, you need to buy a big and better car so that you can Keep Up With The Joneses. And sadly, this is how people with 6 figure incomes tend to live pay check to pay check. So, while your $100,000+ income neighbor is spending all their money, you are saving yours.

Now, I’m sure you’re wondering- how do I save my money and get my spending habits under control? Well, for one- I’d suggest beginning to track your spending so that you can understand what your money is being spent on and which area you really need to cut back on. In order to do this, I’d suggest picking up an expense tracking book through Cleverfox as they have some pretty nice quality ones to choose from. And if you’re wanting something a little more advanced and comprehensive- I’d try this Advanced Budget Planner as it not only has the expense tracker in it, but a budget planner and everything else you will need to track your spending.

Now, when you’re out shopping and looking at something you REALLY want to purchase, think- is this worth the time I spent working to purchase this item? Do I need this? Will it benefit me? If the answer is yes, then go right ahead and purchase it. However, if you’re unsure, then don’t buy it and wait a few days. If you truly want it after that time, then go right ahead. Most of the time though, you will realize that you didn’t actually need or want that item to begin with. This is called the Honey Moon period and everybody experiences it- it just matters how you react to it!

If there is one thing you should notice when looking at all these rich people- it’s that yes, they clearly have expensive things, but they are able to do that because they have the money and limited their wants early on. Nowadays, most people just buy things because they want it in the moment. But you have to dig deeper and understand how they got rich in the first place. They didn’t go around buying everything they wanted- and if they did, they wouldn’t be as successful as they are today.

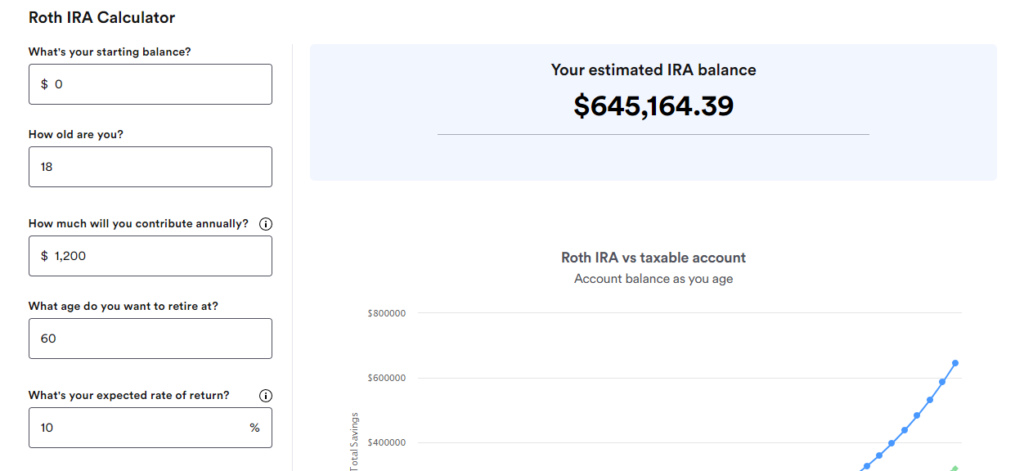

This is why It all starts with investing and saving. Although it should be a known fact-I do want to make sure you know that you can’t save yourself to riches. However, there are some things you can do with your money to become wealthy even on a low salary. And this has to do with investing. I’d highly suggest starting a ROTH IRA through Webull and investing slowly as it’s a great jump start to your future wealth. Here is a little calculation on what your money would look like If you’re 18 and started investing just $100 a month- $1200 a year at an annual 10% return.

By the time you’re 60, you will have made a return of $595,964.39 with a total investment of only $49,200!

Isn’t this just insane? It IS that easy! However, I want you to understand that you need to actually invest inside of your Roth IRA account, not just let the money sit there. I’d highly suggest just putting it in the VOO S&P 500 Index Fund or some other ones as they usually have about an annual 10% average return. This is one of the most risk free investments as the S&P 500 in compiled of the 500 top companies on the stock market. Say one company does bad one year and a different one does exceptionally well- they even each other out! That’s why there is an average 10% yearly return.

When you own something, there should be a reason behind it. Maybe the reason for owning something is for financial gain, transportation or even comfort. There are unlimited reasons for owning something, but I want to specifically talk about investing. If you don’t know what you own, then why in the world are you investing in it? Maybe you own a stock for dividend payouts, long term growth or even just risk management. You need to know why you’ve invested in something so that you aren’t just blindly investing your hard earned cash. Understanding what you’ve invested in will infinitely benefit you as you can make informed decisions and not just emotionally react when markets tank.

So, how should I apply the all knowing in my own life? Well, I’d suggest fully researching anything and everything before you invest. understanding the financials of the company and the risk you are taking on is incredibly important and will help you make your decision. But what if you don’t want to worry about all of that stuff? Well, there is a different route you can take that 100% works for your long term wealth. And that is investing in S&P 500 Index Funds. As I’ve previously stated, it’s comprised of the top 500 companies and will diversify your portfolio for you without having to do all the leg work. It has an annual 10% Average ROI (Rate On Investment). If you’re looking for a recommendation- I’d suggest going with the VOO Index fund as it’s the one I use and is very popular.

It may be a little silly and ironic something like this is being said on a finance blog, but it’s something that really needs to be said. This specific quote needs to be taken to heart as it really tells you that money isn’t everything. Although money is amazing, some people let it change them to the point they aren’t liked or loved by anyone-you definitely don’t want to be that person.

Remember – treat everyone the same no matter how much money they make- we’re all just human beings when it comes down to it.

This quote is from Napoleon Hill-the same person who wrote Think and Grow Rich. And he is incredibly right- you will be paid more if you do more. It may take time- but this is the truth. Someone that works hard, has a good work ethic and does more than their job description entails has a much higher chance of receiving promotions and raises compared to the average joe who is just doing the bare minimum. You are showing your worth in your work and you will be respected for that.

I’ve actually experienced this personally as I have quite the work ethic myself. I used to work at a fast food restaurant when I was 16 and worked there until I was almost 18. During that time, I slowly gained respect and got better at my job, which I then received lots of praises and also a small raise. But 6 months after that, I was 17 and had gained quite the trust and liking to my managers. Due to this, they started teaching me manager duties without even being a manager. They gave me my own manager card, let me count the money for the day and complete the deposits. This is quite the definition of going above and beyond- but it worked! they gave me an almost $2 raise and shortly after that gave me another 75 cent raise. Unfortunately I couldn’t become a manager as I wasn’t 18 at the time, but I would have definitely been one if I wasn’t a minor. But anyways, I just wanted to give you an example as to why it’s so important to go above and beyond no matter what you do.

Educating yourself and working hard is the only way you’re going to be able to break through this barrier that separates the broke and financially free. How are you going to break through this barrier if you don’t how? This is where education comes in and is the key to your success. But let me make something clear- no, I am not saying you NEED to go to college. Education can be reading a book, researching or just watching a Youtube video. I think people are under this spell that makes them believe that you need to pay for education in order to learn well, but that just simply isn’t true. The amount of information out on the internet is infinite and you will never stop learning.

Now, I’m assuming that if you’re reading this- you’re into understanding your personal finances and that is amazing! If you are just getting into finances and wanting to understand it better, I’d suggest reading The Psychology of Money by Morgan Housel or The Richest Man in Babylon by George S. Clason as these are some of the classics. But if you just want to learn about the basics- budgeting, debt elimination and saving- I’d suggest reading The Total Money Makeover by Dave Ramsey.

If you can start learning financial discipline, your future self will love you. I want you to think for just a second- how much would $10,000 help you right now? Would it make you feel secure and safe? If your answer is yes- then I’d say that beginning to save your money instead of spending it on stupid stuff that you won’t find any value in months down the road is an incredible idea!

This quote kind of pairs with the last one. People under appreciate self-educating- but to be honest, most of the people that make millions and even billions are self-educated. When you think about it, people go to college so that they can get a secure job to work for someone else, making that person’s dream come true. These entrepreneurs that work for themselves are profiting off of college graduates when most of the time- they’re not even college graduates themselves!

Overall, achieving the financial success and freedom that you dream of isn’t as far out of reach as you think. All it takes is the right mindset, hard work, knowledge, and actively taking it one step at a time towards your goals. The quotes that I’ve presented to you throughout this article, consisting of some of the wealthiest and greatest financial heads of our time, reminds all of us that wealth comes from hard work, discipline and above all, knowledge.