This post may contain affiliate links, which supports me, but won’t cost anything extra to you.

Saving our money is one of the hardest things to do in these times. But what if I told you it is still a possibility, even with the increased prices of groceries, bills, and about everything else? No, I’m not messing with you- this is an actual possibility. All it takes is a little bit of discipline and planning.

Hello, I'm Wealth Wizard. I am newer to the blogging corner, but I really want to share some of my knowledge when it comes to personal finances as I used to question how to save until I truly understood self-control and knowledgeable decision-making.

- Wealth Wizard is just a funny little name I like to call myself as I help individuals like you build your wealth using simple techniques and strategies.

Beginning to take control of your finances may be very overwhelming, but in the long-term you will realize how much of a blessing it really is. It doesn’t matter if you’re in your 60s or a young adult that has just been introduced to the “real world”. The 7 Saving Techniques I’m about to share with you will truly help you build long-term wealth for your future.

- Now, I will be the first to say that not all of these techniques may work for you-but that’s why there are 7 different techniques-so that you can try to find which one will make the biggest difference in your financial future!

1. The Zero-Based Budgeting (ZBB)

How The ZBB Technique Works : Basically, you’re giving your money a “job”. And what I mean by that, is you’re trying to be intentional with your money. Every dollar you earn, that dollar is intended for something. And after Intentionally spending your money that month, the Moolah you didn’t spend, you Save.

The equation goes “income minus your liabilities will always equal zero.“ (Income – Expenses = $0)

- You Can Then Put That Extra Money Away In Your Savings and Investments.

Who Would Do Well With The ZBB?

This plan is great for someone that wants to have an easy way of tracking and justifying every expense they make.

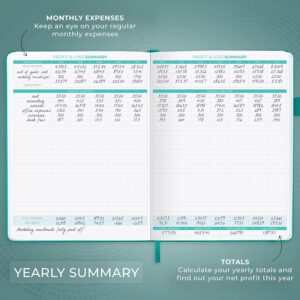

Now, I’m sure you’re wondering-how will I track my expenses though? Well, there are some amazing ways to do so. However, I personally like to do it all physically. I really like CleverFox as they have a nice looking expense tracker that is incredibly easy to use and understand.

2. The 50/30/20 Rule

How The 50/30/20 Rule Works: This technique is a simple way to divide your income: 50% for needs, 30% for wants, and 20% for savings and debt repayment. You may also want to sprinkle some investing in there as well. It’s perfect for those who want a straightforward budgeting strategy.

Who May Fit The 50/30/20 Criteria?

- This simple budgeting strategy works well for people who want a straightforward, flexible approach to managing their finances. This is probably best suited for newer people to budgeting.

Just like the previous strategy, I know you’re wondering how you will track your spending. Although the CleverFox expense tracker is amazing to use, something like a wallet budget, or even just some envelopes to divide your 50/30/20 in could work.

3. The Envelope System

How The Envelope System Works: The Oldest-School Of Them All! You have different envelopes categorized in groceries, bills, dining out, etc with your budget in mind. The money that is put in each one of these envelopes correlate to what you’re allowed to spend for that month.

- The best part about this is the money that you DON’T spend during that month- you put in your savings or investments- It’s like free money!

Ironic enough, I was just talking about envelopes in the previous budget plan, but this is definitely the best one to use the envelopes I recommended.

Who Should Try The Envelope Budget?

Envelope Budgets really are perfect for anyone who want or needs to know where every dollar is going in real-time. It’s especially great for people who have a hard time sticking to their budgets. It’s also a great way to help avoid racking up debt by physically limiting yourself from how much you can spend in each of the categories.

- – I would say that’s a win if I’ve ever seen one! This method really works great if you like working with physical cash and prefer a hands-on approach.

4. Paying Yourself First

How It Works: This method focuses on prioritizing your savings before anything else. You will automatically set aside some money for your savings or even investment accounts-making sure that you meet your financial goals before spending money on anything else.

- Personally, I’d only suggest doing this once you make enough to cover you bills and have a little left over to invest or save. If your problem is not having enough because you spend money on a bunch of useless things, then definitely try this one!

Who Should Pay Themselves First?

Anyone who may be looking to build their long-term wealth, plan for their retirement, or even grow an emergency fund should definitely try the “pay yourself first” strategy. It’s perfect if you struggle to save consistently or tend to spend first and save what’s leftover at the end (usually nothing).

- It doesn’t matter if you’ve just turned 18, a busy parent, or someone that is just focused on their financial independence. This method truly helps make sure that you’re always putting money toward your goals before your expenses get in the way. It is definitely a good fit for anyone that is serious about taking control of their finances and wants to grow their wealth in the long-term.

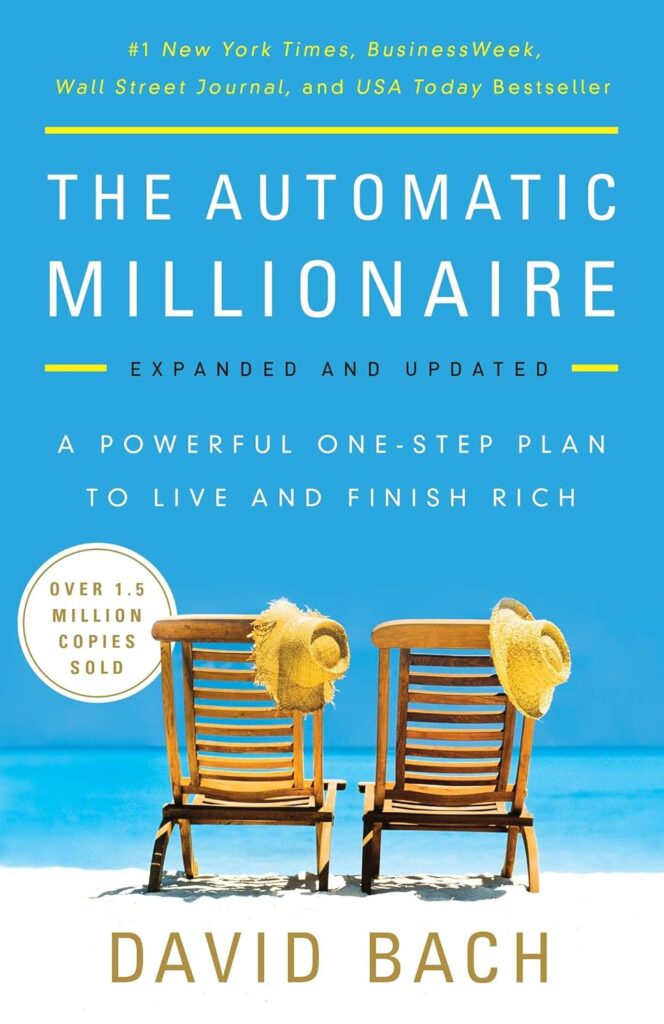

Now, If you’re truly interested in the “Pay Yourself First” strategy, then I’d highly recommend taking a look at “The Automatic Millionaire” by David Bach as it takes a deep dive into building wealth by automating your savings and investments. This book really emphasizes this strategy as it shows how small consistent actions, such as setting up automatic transfers to your savings or retirement accounts-can lead to financial wealth without requiring a high income or the constant of budgeting.

5. 60% Solution Budget

How The 60% Works: In this strategy, 60% of your income goes right towards expenses (like rent, utilities, and groceries). The other 40% will be divided into your long-term savings, retirement, and fun money. It’s actually an incredibly simple and flexible method If you are the type that prefers fewer restrictions.

- Here is an example of what your budget allocation may look like.

- 60% of your income goes towards essential expenses (needs). 40% is divided between the following categories:

- 10% for discretionary spending (e.g., entertainment, dining out).

- 10% for retirement savings.

- 10% for long-term savings (e.g., emergency fund).

- 10% for short-term savings (e.g., vacations, large purchases).

Should You Try The 60% Budget?

This works well for someone that has a consistent and mostly predictable income. It’s definitely a great option if you’re trying to create a simple, but useful financial plan and want to have a clear picture of where your money is going. However, it might not work well for you if you have an irregular income or a very high living cost that exceeds the 60% threshold for the essentials.

6. Reverse Budgeting

How To Reverse Budget: Instead of focusing on all your expenses first, the reverse budget would start by deciding how much you want to save, then you can spend whatever is left after setting that money aside. It’s like a savings-first approach to managing money.

Is Reverse Budgeting Your Thing?

- It’s actually a great strategy if you’re trying to work toward a financial goal such as building an emergency fund, buying a house, or even paying off debt. However, it might not be the most suitable if your current expenses don’t leave too much room for saving.

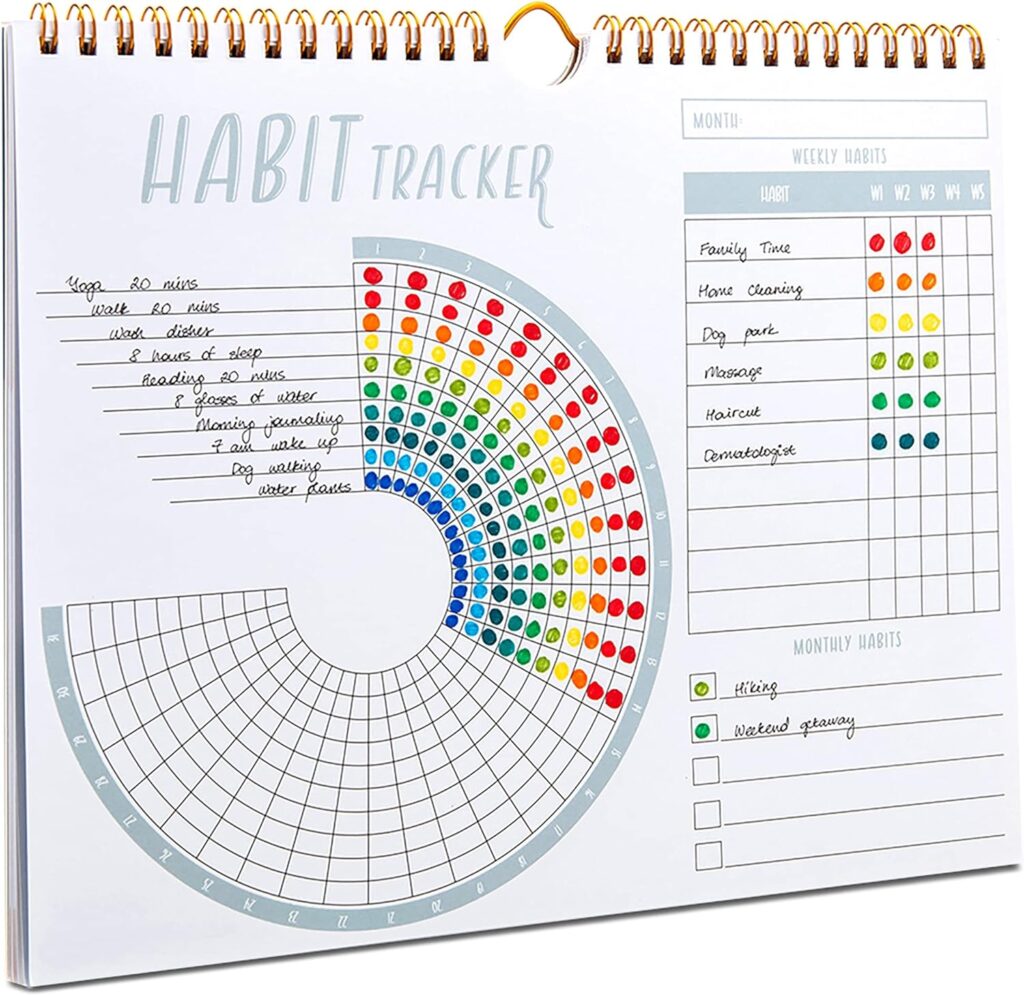

I would actually recommend something like a habit tracker for this as it helps you stay in line with healthy habits-such as saving a certain amount of your pay check every week.

- The Lamare habit Tracker is a great one as you can not only input your saving & spending habits, but other day-to-day habits such as working out too.

- – It’s stylish too!

Overall, you need to choose the budget strategy that works for you as it will make a world of difference. Whether you like more of a structured approach of the 50/30/20 rule, or the flexibility of zero-based budgeting-or even the savings-first mindset of the reverse budget.

- There is 100% without a doubt- a strategy that can fit your lifestyle and financial goals.

Just remember that the best budget for you is the one that you can stay consistent with—so don’t be afraid to try different strategies until you find the right fit for you. Once you’ve found the strategy that works for you, stick to it for the long-term and watch your financial health grow.

[…] 6 SAVING TIPS EVERYONE SHOULD KNOW IN 2024 […]